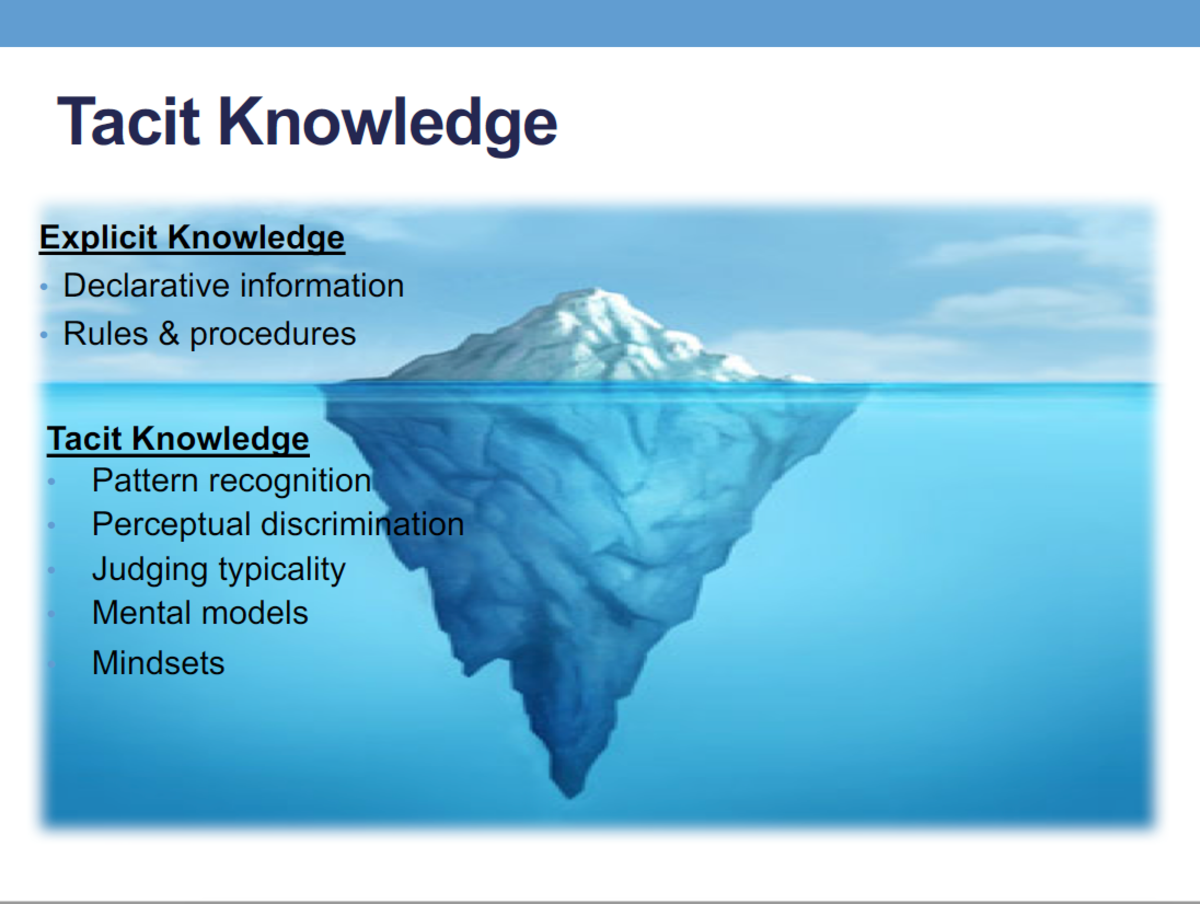

goat68 wrote: ↑Thu Aug 27, 2020 9:09 pmThanks Kai, I love the diagram! I understand what you're saying, and must admit I'm not under the waterline much apart from gaining some pattern recognition from the markets I've traded. I like the Judging Typicality! That's really tricky what is typical? As Peter says, think about what other traders are (typically) thinking...Kai wrote: ↑Thu Aug 27, 2020 12:24 pmIf you look at the bright side at least there's no shortage of forum advice, the oil reserves would run out sooner!

I see a lot of it being repeated and don't want to sound like a broken record but again, what Mr Goat is seeing in videos is just the tip of the iceberg so to speak and he cannot see more than that, there is a lot of hidden implicit (tacit) knowledge that is clearly difficult and near impossible to transfer to another person because it's based off experience. Plus the pros take a lot of knowledge for granted and dish out a lot of implied knowledge as well, that only hints or suggests at something but is not directly expressed, and most of that as you can imagine goes well over the head of newcomers.

That's sort of why I like to discuss trading as openly as I can and will often overshare, and I probably imply a ton when randomly commenting, but as far as newbies are concerned I see prerace swing trading as maybe the most difficult skillset to actually learn right off the bat (maybe only value based approaches are more difficult), because learning everything all at once on how to speculate and how to manage your position and emotions is practically a Forex trading skillset, even though it may appear dead easy

My point being is that Mr Goat is trying to learn proper trading skills and this simply cannot be done overnight, that's probably more of a fact than opinion.

And I wouldn't say that newbies are just getting baited into it either, I believe literally everyone starts off very naive almost by default as that's the nature of trading, and I think there are enough disclaimers in the videos and overall but people usually like to completely ignore them

Something that every newbie has said at least once right after seeing the latest Bet Angel video : "Hold my beer and watch me install Bet Angel to execute on this easy swing."

Cheers

Goat

Trading What I see !?

Hi goat,goat68 wrote: ↑Mon Nov 09, 2020 5:49 pmThanks for the great ideas guys.

I think one limiting aspect I suffer is not having clearly defined 'setups', as I find every market is subtly different, and hardly ever fits a standard setup, so I have to interpret it a bit to make something fit.

Also the markets at the moment seem to be impossible to run winners due to the volatility, so I typically aim for 1:1 risk: reward.

So I'll try and improve these

Thought I should take you back to some the great advice given in this forum and to be frank it’s hard to pick one , the list is long.

The market place has a tendency to behave like an iceberg , kai has captured well what I think is the structure of the market and the activities in it and I personally believe there is a a traded volume structure that is not obvious to a new trader. It’s common to see the market working against your position as soon as your orders are taken, almost like an iceberg collision, where you are only seeing the top and not taking into account what the unseen’ smart money ‘ is doing.

I believe you have an edge coming from an IT background , you could come up with a bot that can jump Order Que and operate at the touch price without moving the price. This would effectively make you a market maker. You are also well equipped to have a database which you can use to model your ideas and convert them into viable bots.

The tricky part is mastering manual trading and to do that you need to master random behaviour of the market. The advice given in this thread alone is enough to make you a successful trading plan.

Let’s say you take a plan that has a stop loss of -3 and a profit target of +1 , it will then yield a 50/50

Win rate. So all you need to do is tget your stakes in to right proportion. Your upside tick value must equal your down side tick value thus leveling up the playing field .

Test your plan first in practice mode and later in live mode , and note the performance as you go through different types of markets.This should allow you to see where Your +1 can be converted into a swing while maintaining your -3 stop loss.

Hope that helps.

Thank you, that does help, it's this sort of thing I'm researching while I take a xmas breakdecomez6 wrote: ↑Fri Dec 18, 2020 10:39 amHi goat,goat68 wrote: ↑Mon Nov 09, 2020 5:49 pmThanks for the great ideas guys.

I think one limiting aspect I suffer is not having clearly defined 'setups', as I find every market is subtly different, and hardly ever fits a standard setup, so I have to interpret it a bit to make something fit.

Also the markets at the moment seem to be impossible to run winners due to the volatility, so I typically aim for 1:1 risk: reward.

So I'll try and improve these

Thought I should take you back to some the great advice given in this forum and to be frank it’s hard to pick one , the list is long.

The market place has a tendency to behave like an iceberg , kai has captured well what I think is the structure of the market and the activities in it and I personally believe there is a a traded volume structure that is not obvious to a new trader. It’s common to see the market working against your position as soon as your orders are taken, almost like an iceberg collision, where you are only seeing the top and not taking into account what the unseen’ smart money ‘ is doing.

I believe you have an edge coming from an IT background , you could come up with a bot that can jump Order Que and operate at the touch price without moving the price. This would effectively make you a market maker. You are also well equipped to have a database which you can use to model your ideas and convert them into viable bots.

The tricky part is mastering manual trading and to do that you need to master random behaviour of the market. The advice given in this thread alone is enough to make you a successful trading plan.

Let’s say you take a plan that has a stop loss of -3 and a profit target of +1 , it will then yield a 50/50

Win rate. So all you need to do is tget your stakes in to right proportion. Your upside tick value must equal your down side tick value thus leveling up the playing field .

Test your plan first in practice mode and later in live mode , and note the performance as you go through different types of markets.This should allow you to see where Your +1 can be converted into a swing while maintaining your -3 stop loss.

Hope that helps.

I feel energised and positive with the idea of Automation

Cheers

if you cant manually trade, why do you think you can automate trading (or aspects of it, such opening, getting out when it gone against you and so on) with any success.

Anyway, I was watching some of the automated bets go through, and I've spotted a good tweak to try tomorrow.

Another thing I noticed a couple of times is the offset bet not being placed. I am using an offset and stop, so not sure what's happened there

Another thing I noticed a couple of times is the offset bet not being placed. I am using an offset and stop, so not sure what's happened there

Why a stop and offset? One of them is certainly not going to be +ev

In order to be profitable you need to place positive ev bets, how is a stop order ever going to be positive ev long term?

It can't be that simple, so you're saying Guardian is crap as it provides tools that are by definition -ev ?

To me if timed in the right market, and you achieve a strike rate and risk/reward correctly you should be able to achieve +ev?

Why would an order that is crossing the spread on the opposite side of your initial (supposed +ve) be positive ev?

Not saying anything is crap but you can’t just apply order types / strategies without thinking about them objectively in terms of expected value.

i've no idea what you are saying, let me try and decompose with an example:LinusP wrote: ↑Mon Dec 21, 2020 7:59 pmWhy would an order that is crossing the spread on the opposite side of your initial (supposed +ve) be positive ev?

Not saying anything is crap but you can’t just apply order types / strategies without thinking about them objectively in terms of expected value.

Ranging stable price, enter reverse best price Back at 5.5, Stop 5.8, Offset(lay) 5.4

Spread current = 5.4-5.5

Price move 1tick, new spread = 5.3-5.4, Offset(lay) bet matched for 1tick profit

Sorry, still don't understand what you are saying, you need to come down to my level please?