I won't be sharing exact mechanics behind the models, as that would pretty much reveal the edge (if there is one at all), but I will share performance stats, Montecarlo outputs, and some observations. I'm genuinely interested in discussion, critique, and seeing how others approach similar concepts. Is it sustainable? Am I not seeing something obvious that will break the strategy soon?

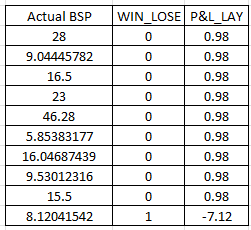

Over the last 90 days, I’ve put both strategies through testing using £1 stakes. Below are the high-level results before compounding, staking plans, or anything fancy — just flat stakes applied to raw model selections.

BACK STRATEGY:

Bets: 2984

Total P&L: £222.57 (based on £1 stakes)

Mean per bet: 0.0746

Average odds: 3.74

Win rate: 38%

Loss rate: 62%

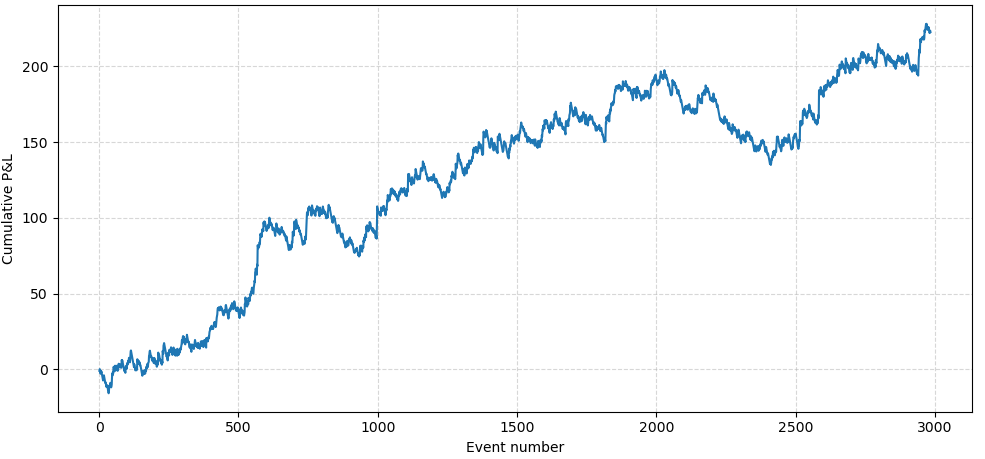

Montecarlo output:

12 month (£1 stakes)

P&L distribution, 10000 12-month simulations:

This is very much a high-volume, low-yield approach, chipping away with small but consistent gains. The strike rate isn’t anything spectacular on the surface, but the pricing efficiency seems to be doing the heavy lifting — the model appears to pick dogs that are regularly mispriced at the BSP. Over the 90-day test window, the strategy produced a £222 profit from flat £1 stakes, which isn’t life-changing, but it’s steady and importantly, easily scalable, since it's betting on BSP.

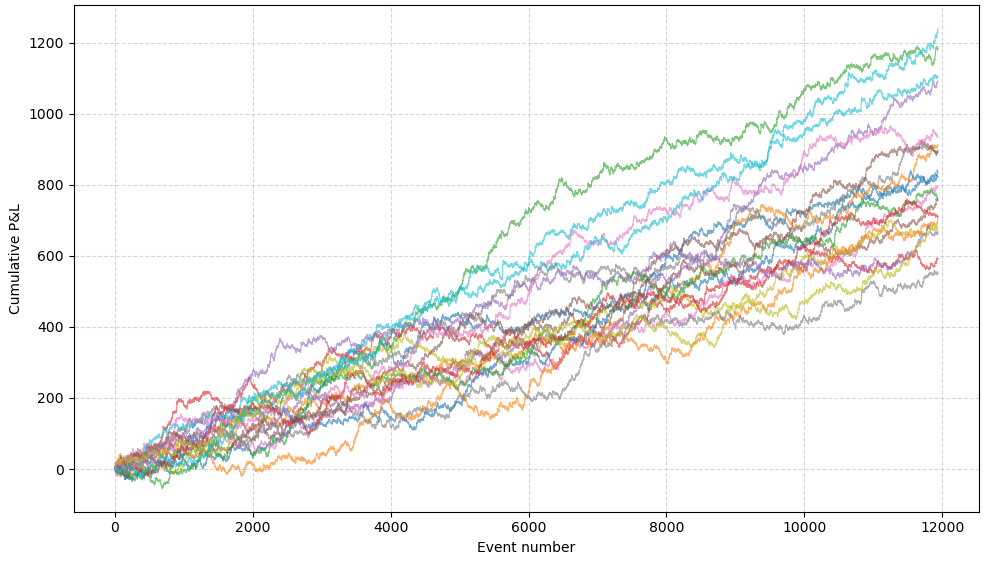

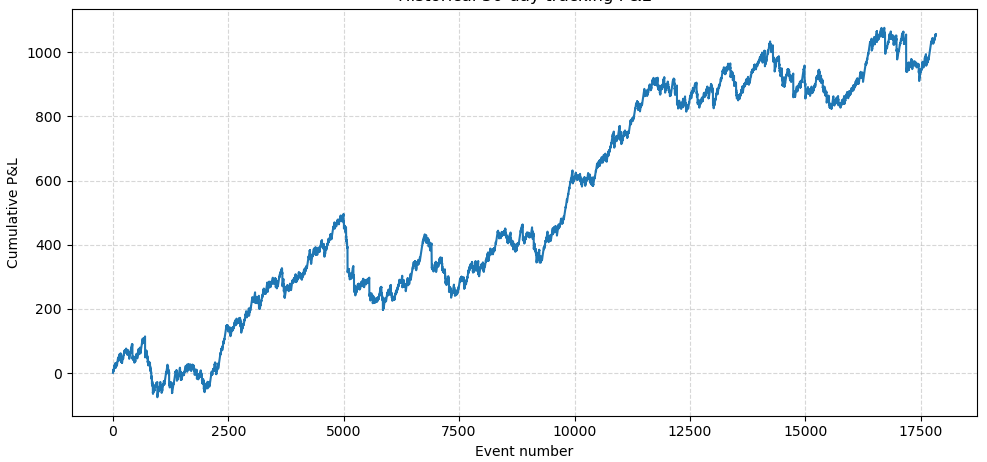

LAY STRATEGY:

Bets: 17827

Total P&L: £1,056.53 (based on £1 stakes, not liability)

Mean per bet: 0.0593

Average odds: 17.8

Win rate: 88.65%

Loss rate: 11.35%

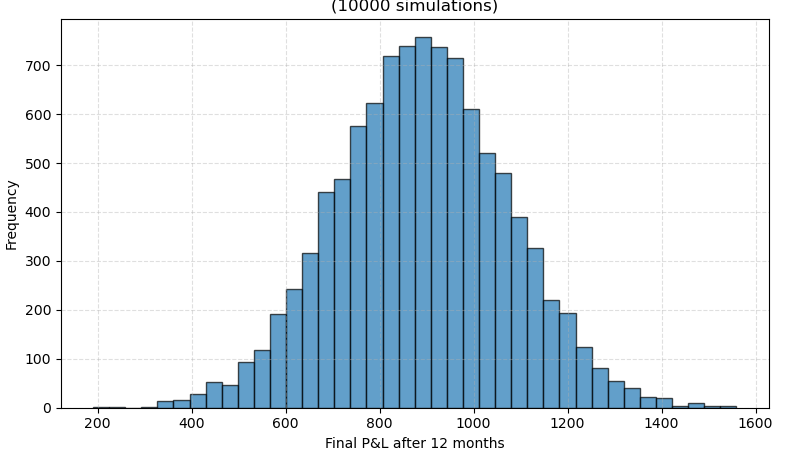

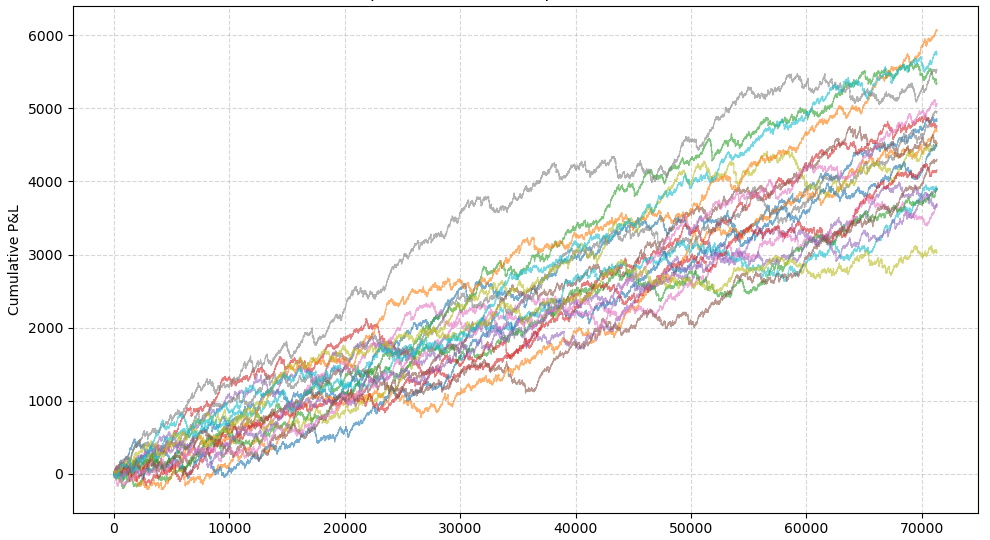

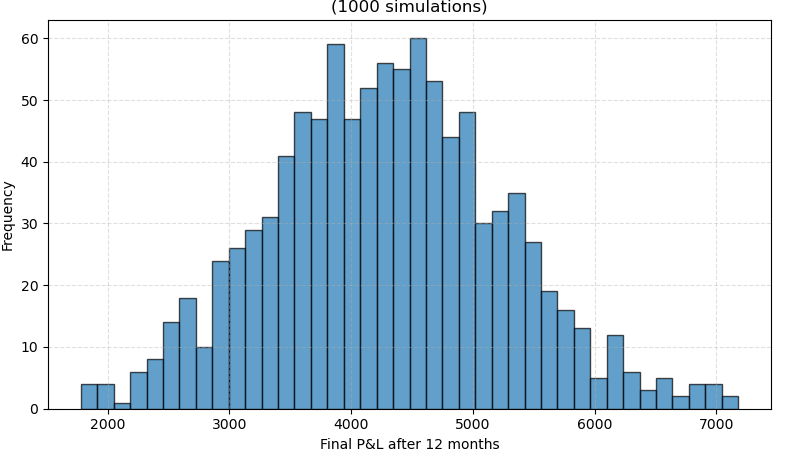

Montecarlo output:

12 month (£1 stakes)

P&L distribution, 1000 12-month simulations:

This strategy operates at the extreme end of the high-volume, low-yield spectrum. On paper, it absolutely dwarfs the Back Strategy in raw profit, returning just over £1,000 from flat £1 stakes across nearly 18,000 bets in 90 days. The hit rate is great — close to 89%. And both the equity curve and Montecarlo projections suggest a very robust upward trajectory over a 12-month period.

However, the apparent profitability needs to be viewed in context. The average lay odds are 17.8, which is frankly uncomfortable territory. Yes, the strike rate keeps the model afloat, but the occasional loser is catastrophic in relative size. When calculating ROI using liability (not the stake), the percentage return collapses to something only marginally above breakeven. That means the strategy isn’t generating large edges per bet — it's simply grinding out thousands of tiny edges and relying on volume to make them visible.

This introduces a practical problem: bankroll requirements. To survive the inevitable losing runs when laying at these odds, you need a very deep wallet and the psychological tolerance to watch large liabilities materialise without flinching.

Final Thoughts / Discussion

One thing I’ve always believed — long before I even wrote a line of code — is that the greyhound markets are incredibly efficient. BSP feels like a brutally accurate reflection of a dog’s true winning chances. And maybe it still is. But these results have left me wondering whether there are pockets of inefficiency that can be systematically exploited… or whether I’ve just been lucky enough to stumble into one during a favourable period.

Both strategies suggest (if that’s the right word) that some kind of edge exists. I’m not claiming I’ve cracked the code or found a magic formula — far from it — but the numbers do raise the question: is this sustainable, or is it simply variance masquerading as skill? The sample sizes are large enough that it feels meaningful, yet part of me keeps thinking I’m missing something obvious that more experienced people take for granted.

So I guess that’s what I’m hoping to understand here. Is this the kind of thing that burns bright for a few months before collapsing? Or is it possible that a casual programmer with a bit of domain knowledge really can uncover inefficiencies that the market hasn’t fully priced in? Can I reasonably expect this to keep working for another three months? A year? Three years? Or am I already bumping into the ceiling and shouldn’t be too proud of myself?

Don’t worry — I’m not quitting my job, mortgaging the house, and buying a yacht called “BSP Beater”. I’m just genuinely curious whether what I’m seeing is:

1. a legitimate, scalable edge,

2. a temporary quirk that will get arbitraged away, or

3. nothing special at all and I’ve just been playing in a statistical sweet spot.

I’d really appreciate honest thoughts from anyone who’s been around this space longer than I have.

Does this look promising, naïve, dangerous, or boringly normal?