House prices rise in the long term is linked to wages. If you want to predict the likely return of housing over a 20 year period or so then add current yeild+gdp+average earnings inflation and there is your return metric.

If prices are high your return will be low, if prices are low your return will be high. Price you pay and value is what you get. If interest rates rise then prices will need to fall to balance the rental yeild but yeilds have been rising on demand.

I wouldn't 'short' housing except where it is obviously significantly overvalued. Even if interest rates rise it will only deflate returns, only if they rocket up will they cause prices to crash. Even then, if you are a very long term holder, timing wont make a siginficant difference to you.

Pensions/Investment

- CaerMyrddin

- Posts: 1271

- Joined: Mon Sep 07, 2009 10:47 am

Very interesting reading.

I've been puting aside a fixed percentage of my income and I'm looking into investing too. The latest by the end of the summer, I'm coming up with my strategy, but I must say it's being hard to filter information, there are so many different sources and ways of looking into things that sometimes I get confused, it's hard to put things down to the basics, especially as we are living turbulent times.

In the meanwhyle I've been simply compounding interest. I've been taking part in deposit's auctions with short periods (from 30 to 90 days). It can't go too wrong and I thought it was a good way to start things up.

Unfortunately me and my brothers inherited and apartment and decided to rent it. It's paying off, but only because we managed to get a higher rent than market prices. We rent it to female students, but if it wasn't for this, it wouldn't pay the work it comes with!

I've been puting aside a fixed percentage of my income and I'm looking into investing too. The latest by the end of the summer, I'm coming up with my strategy, but I must say it's being hard to filter information, there are so many different sources and ways of looking into things that sometimes I get confused, it's hard to put things down to the basics, especially as we are living turbulent times.

In the meanwhyle I've been simply compounding interest. I've been taking part in deposit's auctions with short periods (from 30 to 90 days). It can't go too wrong and I thought it was a good way to start things up.

Unfortunately me and my brothers inherited and apartment and decided to rent it. It's paying off, but only because we managed to get a higher rent than market prices. We rent it to female students, but if it wasn't for this, it wouldn't pay the work it comes with!

Hi CaerMyrddin

You might want to read up on trend following - this book is a good place to start: http://www.amazon.co.uk/Trend-Following ... 341&sr=1-1.

The Turtles also used a form of trend following: http://www.amazon.co.uk/Complete-Turtle ... gy_b_img_b

Trend following has its critics, but it's a simple approach that's used by some of the most successful traders in the world (including John W Henry, who owns Liverpool FC).

Jeff

You might want to read up on trend following - this book is a good place to start: http://www.amazon.co.uk/Trend-Following ... 341&sr=1-1.

The Turtles also used a form of trend following: http://www.amazon.co.uk/Complete-Turtle ... gy_b_img_b

Trend following has its critics, but it's a simple approach that's used by some of the most successful traders in the world (including John W Henry, who owns Liverpool FC).

Jeff

CaerMyrddin wrote:Very interesting reading.

I've been puting aside a fixed percentage of my income and I'm looking into investing too. The latest by the end of the summer, I'm coming up with my strategy, but I must say it's being hard to filter information, there are so many different sources and ways of looking into things that sometimes I get confused, it's hard to put things down to the basics, especially as we are living turbulent times.

- CaerMyrddin

- Posts: 1271

- Joined: Mon Sep 07, 2009 10:47 am

I'm with Peter on this one Jeff, I'm looking into investing and not speculating, if I'm to speculate I'm better in betfair

I took a few cold feet in the stock market some years ago. I managed to be stoped 3 times by one cent and in a certain way it is not a leveled field, it's almost impossible to beat the guys with higher clearance levels.

Transaction costs are very high if you are starting with a small bank. If I had no trasaction costs I'd be positive on the stock market, as I don't...

Now i only get involved in IPOs with tight stops in the first day the stocks are in the market.

I took a few cold feet in the stock market some years ago. I managed to be stoped 3 times by one cent and in a certain way it is not a leveled field, it's almost impossible to beat the guys with higher clearance levels.

Transaction costs are very high if you are starting with a small bank. If I had no trasaction costs I'd be positive on the stock market, as I don't...

Now i only get involved in IPOs with tight stops in the first day the stocks are in the market.

Whichever way you look at it, you're speculating.

Even if you stick your money in a bank account, you're still speculating, as inflation could outstrip interest.

And if you use fundamental analysis, it's a bit like looking at horse's form to asses its true chances. A few people can beat the market consistently, but not many...

Re: Transaction costs - they aren't too bad if you're trading on the 5 or 15 minute charts, so if you're on the daily chart, they're fairly negligible.

Jeff

Even if you stick your money in a bank account, you're still speculating, as inflation could outstrip interest.

And if you use fundamental analysis, it's a bit like looking at horse's form to asses its true chances. A few people can beat the market consistently, but not many...

Re: Transaction costs - they aren't too bad if you're trading on the 5 or 15 minute charts, so if you're on the daily chart, they're fairly negligible.

Jeff

CaerMyrddin wrote:I'm with Peter on this one Jeff, I'm looking into investing and not speculating, if I'm to speculate I'm better in betfair

No, that is where things have gone wrong in the world, people have forgotten what an investment is and what speculation is.

If I needed money to buy a second factory but couldn't afford it. I would go to an investor to provide the money and he would expect a return. I could go to the bank but that would increase the potential for bankruptcy. An investor lends me money at his risk in hope of a decent return. I get my factory and a higher ROC for little risk.

If I wanted to specualtive I would dump the lot on rubber commodities and hope I can sell it to somebody for a higher price. I didn't make, invest or own anything other than the right to perhaps profit at somebody elses expense.

If I needed money to buy a second factory but couldn't afford it. I would go to an investor to provide the money and he would expect a return. I could go to the bank but that would increase the potential for bankruptcy. An investor lends me money at his risk in hope of a decent return. I get my factory and a higher ROC for little risk.

If I wanted to specualtive I would dump the lot on rubber commodities and hope I can sell it to somebody for a higher price. I didn't make, invest or own anything other than the right to perhaps profit at somebody elses expense.

- CaerMyrddin

- Posts: 1271

- Joined: Mon Sep 07, 2009 10:47 am

I guess that if I decided to start my own bussiness you'd still argue that I'm speculatingWhichever way you look at it, you're speculating.

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

+1. That is exactly what happened with property. People continued to call it an investment when really it was pure speculation based on the expectation of ever rising prices. That's why the banks are so much to blame - they got caught up in the frenzy and lent to anyone who wanted to take that leveraged bet. It reached extremes in Ireland and was very bad in the US - the UK is still in denial.Euler wrote:No, that is where things have gone wrong in the world, people have forgotten what an investment is and what speculation is.

I think it all boils down to how you choose to define these things.

I'm sure that successful Commodity Trading Firms would argue that they do invest money, inasmuch as they have a long-term positive expectancy.

When you purchase bets, do you consider that to be a form of investment?

Also, surely buying shares in someone's company is speculative in the sense that the company's share price could tumble permanently, or the company could go bust, or it might tie up funds that could have been used for a more profitable venture.

Jeff

I'm sure that successful Commodity Trading Firms would argue that they do invest money, inasmuch as they have a long-term positive expectancy.

When you purchase bets, do you consider that to be a form of investment?

Also, surely buying shares in someone's company is speculative in the sense that the company's share price could tumble permanently, or the company could go bust, or it might tie up funds that could have been used for a more profitable venture.

Jeff

Euler wrote:No, that is where things have gone wrong in the world, people have forgotten what an investment is and what speculation is.

I agree. But a good trend follower doesn't expect anything to happen, and merely rides the wave for as long as it lasts, and gets out quickly when the price goes against him.superfrank wrote: +1. That is exactly what happened with property. People continued to call it an investment when really it was pure speculation based on the expectation of ever rising prices.

The people who lose big time are the guys who prefer not to take a hit, and hang onto their commodity rather than exit when it's going south. It's a bit like the financial markets equivalent of going in play!

Jeff

Well allot of people clearly disagree with me  ,

,

Like im sure they would with some of my Betfair trading methods , but im fine with going against the grain abit,

, but im fine with going against the grain abit,

i maintain what i have said that long term you will not regret buying uk property,

As for whether it's speculation or investing that’s up to others to decide. I don't put much importance on such definitions myself, doesn't really matter to me what it's called .

.

The fact is even if you were to buy a house at the last peak the last time the houseing bubble burst in 1990 your not getting that bad of a deal twenty years on, even with the resent crash.

Im sure those people don’t particular regret there decision to buy now, the people I know that bought second homes at that time don’t anyway, good rental income for 20 years and a good increase in house value even if they choose to sell right now.

I suspect it will be the same with those people who bought in 2006 eventually, althoe of cause allot of people lose out big time short term if they went into it blindly and without doing there maths and having a plan.

I actually do have one property myself that is probably worth very slightly less than I paid for it , but It’s income generating so i have not lost anything in real terms and am very positive I will see profits from the house sale when I choose to sell it in 10years + time.

, but It’s income generating so i have not lost anything in real terms and am very positive I will see profits from the house sale when I choose to sell it in 10years + time.

I dont know how much i will make on it of cause, i could guess but there is not alot of point in that,

but one thing im sure of, i will makeing one hell of alot more than just sicking my money in the bank.

And it is definatly a very low risk investment to me, im not sure of too many other things that carries less risk actually.

Even if the property gains nothing over the next 10 years i will at least come out with some profits from the rental income.

Like im sure they would with some of my Betfair trading methods

i maintain what i have said that long term you will not regret buying uk property,

As for whether it's speculation or investing that’s up to others to decide. I don't put much importance on such definitions myself, doesn't really matter to me what it's called

The fact is even if you were to buy a house at the last peak the last time the houseing bubble burst in 1990 your not getting that bad of a deal twenty years on, even with the resent crash.

Im sure those people don’t particular regret there decision to buy now, the people I know that bought second homes at that time don’t anyway, good rental income for 20 years and a good increase in house value even if they choose to sell right now.

I suspect it will be the same with those people who bought in 2006 eventually, althoe of cause allot of people lose out big time short term if they went into it blindly and without doing there maths and having a plan.

I actually do have one property myself that is probably worth very slightly less than I paid for it

I dont know how much i will make on it of cause, i could guess but there is not alot of point in that,

but one thing im sure of, i will makeing one hell of alot more than just sicking my money in the bank.

And it is definatly a very low risk investment to me, im not sure of too many other things that carries less risk actually.

Even if the property gains nothing over the next 10 years i will at least come out with some profits from the rental income.

Last edited by freddy on Tue May 03, 2011 4:35 pm, edited 6 times in total.

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

Telegraph - Central banks pump £3 trillion into world economy

http://www.telegraph.co.uk/finance/econ ... onomy.html

"The figures will intensify fears that the extraordinary injection of liquidity is responsible for rising stock markets, rather than any underlying pick-up in corporate health or investor confidence".

The article is mentioned in the latest Keiser Report... http://rt.com/programs/keiser-report/ep ... -lobbying/ - give it a watch for an alternative view on the present economic situation. A good interview with Peter Schiff in the 2nd half.

http://www.telegraph.co.uk/finance/econ ... onomy.html

"The figures will intensify fears that the extraordinary injection of liquidity is responsible for rising stock markets, rather than any underlying pick-up in corporate health or investor confidence".

The article is mentioned in the latest Keiser Report... http://rt.com/programs/keiser-report/ep ... -lobbying/ - give it a watch for an alternative view on the present economic situation. A good interview with Peter Schiff in the 2nd half.

Last edited by superfrank on Wed May 04, 2011 1:27 am, edited 1 time in total.

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

UK households 'face £780 drop in disposable incomes'

http://www.bbc.co.uk/news/business-13264496

Bank of England Governor Mervyn King warns on interest rate rise

http://www.telegraph.co.uk/finance/econ ... -rise.html

Roughly translated he says that, hike, and the housing market will collapse pulling the banks down with it. IMHO rates won't rise for years - the BoE doesn't give a damn about inflation (its primary remit) - it's all about protecting the banks and those with assets.

Back to the pensions subject - it's interesting that the BoE moved it's own pension fund into index-linked securites a couple of years ago.

From 2009: The Bank of England’s gilty secret: betting on inflation?

http://ftalphaville.ft.com/blog/2009/03 ... inflation/

http://www.bbc.co.uk/news/business-13264496

We are now treated to warnings from the MSM that even a small rise in interest rates would be "disastrous".Real earnings are "all but certain" to fall for the fourth year in a row - for the first time since the 1870s.

Bank of England Governor Mervyn King warns on interest rate rise

http://www.telegraph.co.uk/finance/econ ... -rise.html

Roughly translated he says that, hike, and the housing market will collapse pulling the banks down with it. IMHO rates won't rise for years - the BoE doesn't give a damn about inflation (its primary remit) - it's all about protecting the banks and those with assets.

Back to the pensions subject - it's interesting that the BoE moved it's own pension fund into index-linked securites a couple of years ago.

From 2009: The Bank of England’s gilty secret: betting on inflation?

http://ftalphaville.ft.com/blog/2009/03 ... inflation/

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

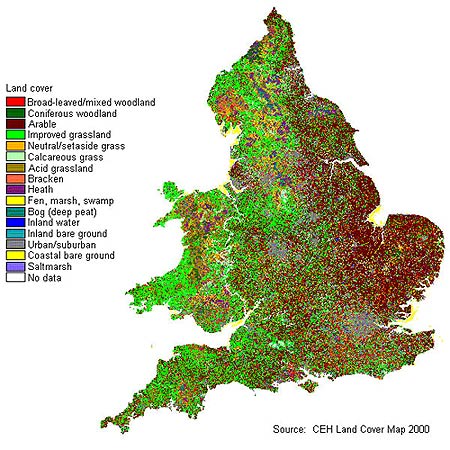

There's plenty of land, that's just estate agent spin. If you fly over the UK you realise how little land is actually developed.Innertube wrote:They don't build land anymore

House prices starting to turn down again (-1.1 per cent in March, which is the largest monthly fall since February 2009)...

Land Registry 4th May 2011

http://www1.landregistry.gov.uk/upload/ ... b10pv4.pdf