Lots of chatter about whether or not we are in another bubble, this time caused by interest in 'AI stocks'.

Personally, I've seen this all before, and I think we are. But there will be winners; you just have to avoid the most obvious errors.

My personal playbook is from what I saw in the Dot Com boom.

Slowly but surely people work their way around various stocks, making the case for why it's the next AI winner. People start buying and when the price moves, people pile in and push the price higher. But eventually the price will have to revert unless earnings follow.

But in the short term, there is plenty of upside if you can spot the next mover. Even if you can't buy many different things will see you sit on a small loss or gain, but with the occasional big winner.

Just don't be tempted to sit on them for too long.

AI bubble

- ruthlessimon

- Posts: 2228

- Joined: Wed Mar 23, 2016 3:54 pm

Will it boom? Yes.

Will it crash? Yes.

Will central banks save the day? Also yes.

Assetless cash hoarding wagies will pay the tab.

Will it crash? Yes.

Will central banks save the day? Also yes.

Assetless cash hoarding wagies will pay the tab.

- ruthlessimon

- Posts: 2228

- Joined: Wed Mar 23, 2016 3:54 pm

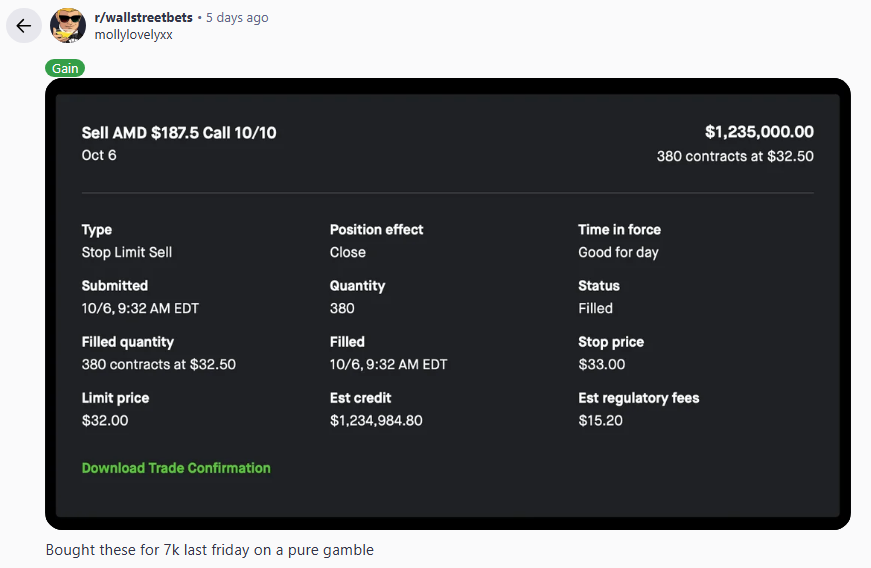

I'm so jealous of these people

You do not have the required permissions to view the files attached to this post.

There was no bail out of the dot com bubble, though the fed did ease interest rates.ruthlessimon wrote: ↑Sat Oct 11, 2025 7:52 pmWill it boom? Yes.

Will it crash? Yes.

Will central banks save the day? Also yes.

Assetless cash hoarding wagies will pay the tab.

Nobody should be bailed out of overpaying for stock. But leverage makes things so much worse than it should be.

Great memers

And the real mavericks

There are a lot of things that have been 'revalued' significantly recently.

I've been buying up positions in aligned industries because it feels like any could pop up at any moment.

It's a bit mad at the moment, which is why it feels like a bubble to me. Prices big up way beyond potential earnings increases.

I've been buying up positions in aligned industries because it feels like any could pop up at any moment.

It's a bit mad at the moment, which is why it feels like a bubble to me. Prices big up way beyond potential earnings increases.

-

sionascaig

- Posts: 1727

- Joined: Fri Nov 20, 2015 9:38 am

I found the following interesting:

https://www.morganstanley.com/im/en-us/ ... arket.html

Key takeaways for me:

==> not a great time for longer term investment returns, if buying now..

https://www.morganstanley.com/im/en-us/ ... arket.html

Key takeaways for me:

==> not a great time for longer term investment returns, if buying now..

You do not have the required permissions to view the files attached to this post.

- ruthlessimon

- Posts: 2228

- Joined: Wed Mar 23, 2016 3:54 pm

I remember value investors calling Nvidia the “next Cisco” at $40 based on P/E. Some shorted and got wrecked. What they missed: Nvidia kept hitting and beating earnings estimates.

- ruthlessimon

- Posts: 2228

- Joined: Wed Mar 23, 2016 3:54 pm

Imho 2008 and investment apps have changed the game.

It doesn’t matter if the bubble is speculative, because the reverse wealth effect would cripple western economies.

S&P 500 drops 50% → average Joe feels poorer → consumer spending collapses → businesses miss earnings → unemployment spikes → governments can’t afford higher yields → cue the money printer.

The game is rigged. capitalism is now socialism for the rich (risks are outsourced, gains aren’t)

Heads: AI takes off - investors win big.

Tails: AI fails - policymakers defend the market. Or they get voted out.

Businesses that make bad decisions should be allowed to fail, thereby putting moral hazard back into the system.

But in 2008, we faced a difficult choice: bail out with a slightly uneven payoff or let the entire economy collapse, creating a dire situation. So it was the lesser of two evils.

The role of government in the current cycle should be to say, if you have a punt on any of these stocks, you could lose everything, and we are not going to help you.

Personally, I believe encouraging investment and risk-taking is good in the long term, but you need moral hazard. I don't believe making everybody the same leads to better outcomes in the long term.

But in 2008, we faced a difficult choice: bail out with a slightly uneven payoff or let the entire economy collapse, creating a dire situation. So it was the lesser of two evils.

The role of government in the current cycle should be to say, if you have a punt on any of these stocks, you could lose everything, and we are not going to help you.

Personally, I believe encouraging investment and risk-taking is good in the long term, but you need moral hazard. I don't believe making everybody the same leads to better outcomes in the long term.

- ruthlessimon

- Posts: 2228

- Joined: Wed Mar 23, 2016 3:54 pm

Some speculative stocks will never recover - Zoom is a prime example. But imo the big s&p 500 players are effectively backstopped. Hence why they trade more like bonds these days.

Small caps: Capitalism

Large caps: Policy instruments

Small caps: Capitalism

Large caps: Policy instruments

- ruthlessimon

- Posts: 2228

- Joined: Wed Mar 23, 2016 3:54 pm

I was thinking about this again today as all the “AI bubble” videos keep popping up on my feeds. Not exactly a contrarian take anymore, clearly.

From what I can tell, public exposure to AI is basically the Mag 7. Sure, AI hype might cause short-term corrections, 20/30% in these names - but that’s not a crash or systemic long-term risk becuase these stocks have monster balance sheets, etf inflows & fed support. The actual bubble, if any, is in private AI valuations, not listed stocks.

"What about Nvidia’s circular earnings". But Nvidia is a shovel seller: it sells real hardware that powers AI. Their earnings aren’t a narrative - it's cash in, products out. If AI growth fizzles, they'll fall 50/60%, but imo this doesnt tank everyone. Because AI enhances existing structures as opposed to the dot.com. Pets.com had zero revenue; Microsoft is a juggernaut.

Or maybe I'm about to get rinsed - 1990s Japan style (cos everythings linked/cape p/e or sumthin) - but if I do, fair play to the cashies. I'll take responsibility

From what I can tell, public exposure to AI is basically the Mag 7. Sure, AI hype might cause short-term corrections, 20/30% in these names - but that’s not a crash or systemic long-term risk becuase these stocks have monster balance sheets, etf inflows & fed support. The actual bubble, if any, is in private AI valuations, not listed stocks.

"What about Nvidia’s circular earnings". But Nvidia is a shovel seller: it sells real hardware that powers AI. Their earnings aren’t a narrative - it's cash in, products out. If AI growth fizzles, they'll fall 50/60%, but imo this doesnt tank everyone. Because AI enhances existing structures as opposed to the dot.com. Pets.com had zero revenue; Microsoft is a juggernaut.

Or maybe I'm about to get rinsed - 1990s Japan style (cos everythings linked/cape p/e or sumthin) - but if I do, fair play to the cashies. I'll take responsibility

- Big Bad Barney

- Posts: 379

- Joined: Mon Feb 04, 2019 6:00 am

AI is useful...even if it hit the ceiling in what it can do and didn't progress anywhere from here...people would still be paying for it...(or at least I do/would)

Pretty sure that much of that dotcom bubble stuff was like...oh free money...ok lets do stupid stuff with it...

Pretty sure that much of that dotcom bubble stuff was like...oh free money...ok lets do stupid stuff with it...

I read that only 5% of GPT users pay/are willing to pay for it.

https://www.theregister.com/2025/10/15/ ... r_few_pay/

If true, where is the revenue expected to come from?

https://www.theregister.com/2025/10/15/ ... r_few_pay/

If true, where is the revenue expected to come from?

- ruthlessimon

- Posts: 2228

- Joined: Wed Mar 23, 2016 3:54 pm

Imo, if AI can’t be monetised, the likely scenario is a Nvidia crash, a Mag 7 correction, and a small-cap resurgence driven by the productivity gains of free AI. But if AI can be monetised, the tech giants will cement a permanent monopoly that could last for decades.weemac wrote: ↑Sat Oct 18, 2025 12:50 pmI read that only 5% of GPT users pay/are willing to pay for it.

https://www.theregister.com/2025/10/15/ ... r_few_pay/

If true, where is the revenue expected to come from?

Free AI = wealth redistribution

Paid AI = wealth concentration

If I was running a fund I'd now be sending my rainmen to their basements to model this forward. But it's too complex so I just stick to degen momentum + index & chill