Retire!

AI bubble

- ruthlessimon

- Posts: 2228

- Joined: Wed Mar 23, 2016 3:54 pm

Winners don’t need ideas, I hope you didn't sell

Last edited by ruthlessimon on Fri Jan 02, 2026 6:46 pm, edited 1 time in total.

- ShaunWhite

- Posts: 10691

- Joined: Sat Sep 03, 2016 3:42 am

Previous gains or losses don't come into the equation, do what's right now.

- ruthlessimon

- Posts: 2228

- Joined: Wed Mar 23, 2016 3:54 pm

ShaunWhite wrote: ↑Fri Jan 02, 2026 6:46 pmPrevious gains or losses don't come into the equation, do what's right now.

Anyway, as Peter has already said, this is not a bubble, it's just the cap-ex part of the cycle, like the early 2000's when they had to physically build out the internet, it took billions in capital, which created millions of new kinds of jobs and even more Trillions in market cap. Yeah, at times the cycle can get a little overheated, but this build out of power generation, power distribution, Fabs, and datacenters has to happen.

If technology is going to save humanity from the monumental demographics problem it has got itself into...trying to call the top is pointless, just keep investing and chill.

If technology is going to save humanity from the monumental demographics problem it has got itself into...trying to call the top is pointless, just keep investing and chill.

My plays for '26 are all around raw materials and energy production, CEG, UUUU, ABAT, MP, MTM, NEE are some tickers im adding to on dips

- firlandsfarm

- Posts: 3549

- Joined: Sat May 03, 2014 8:20 am

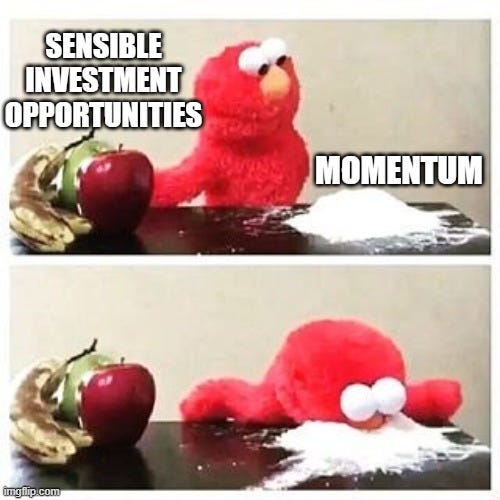

If you want upside you need to pay the vol, its that simple. As the old classic line goes, "it's not timing the market, its time IN the market that builds wealth"firlandsfarm wrote: ↑Sun Jan 04, 2026 2:37 pmIsn't that what they said just before the .com bubble burst?

There's always a reason to sell and so far none of them have turned out to be correct, they were all just value buying opportunities... you can hardly see the 00 crash on the charts these days, its was nothing more than a tiny blip...

You do not have the required permissions to view the files attached to this post.

- firlandsfarm

- Posts: 3549

- Joined: Sat May 03, 2014 8:20 am

Depends on the chart and if you were holding .com assets in the first quarter of 2000!

You do not have the required permissions to view the files attached to this post.

- firlandsfarm

- Posts: 3549

- Joined: Sat May 03, 2014 8:20 am

I was and I added to my positions through out the entire period....That's not in anway me trying to "flex" as the kids might say. It's just that when you know that stocks structurally go up over time, any massive sakeout is always time to add on...

Nathan Mayer Rothschild

The time to buy is when there's blood in the streets, even if the blood is your own

Nathan Mayer Rothschild

- firlandsfarm

- Posts: 3549

- Joined: Sat May 03, 2014 8:20 am

- ruthlessimon

- Posts: 2228

- Joined: Wed Mar 23, 2016 3:54 pm

Another crazy day for mem stocks

All ahead full, Mr Moody

All ahead full, Mr Moody