Jacques Delors: Euro was flawed from beginning

http://www.bbc.co.uk/news/world-europe-16016131

Eurozone debt crisis

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

rare to get something like this from the European elite, so credit to him - at least he's now admitted what we always knew.Euler wrote:Jacques Delors: Euro was flawed from beginning

http://www.bbc.co.uk/news/world-europe-16016131

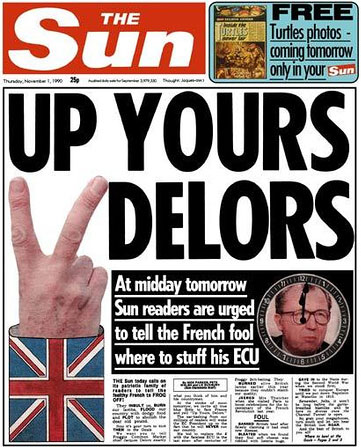

remember this?!

The Sun today calls on its patriotic family of readers to tell the feelthy French to FROG OFF!

They INSULT us, BURN our lambs, FLOOD our country with dodgy food and PLOT to abolish the dear old pound.

Now it's your turn to kick THEM in the Gauls

...

They BURNED alive British lambs earlier this year because they couldn't match our quality. They also:

JEERED Mrs Thatcher when she visited Paris to boost celebrations for the bi-centenary of the French Revolution last year

BANNED British beef after falsely claiming it had mad cow disease

BLEATED when we found their foul soft cheese was riddled with listeria bugs

GAVE IN to the Nazis during the Second World War when we stood firm

TRIED to conquer Europe until we put Napoleon down at Waterloo in 1815 and

Remember folks, it won't be long before the garlic-breathed bastilles will be here in droves once the Channel Tunnel is open

S&P 'to warn Germany and five other AAA euro nations' - http://www.bbc.co.uk/news/business-16042346

We could soon have a situation where Britain is one of the world's few remaining safe havens, ranked above the USA, Japan, Germany and France!

'Surreal' is the word that comes to mind...

Let's hope we don't meet the fate of Switzerland, who had to intervene in the currency markets to lower the value of the franc to make the country's exports less expensive...

Jeff

We could soon have a situation where Britain is one of the world's few remaining safe havens, ranked above the USA, Japan, Germany and France!

'Surreal' is the word that comes to mind...

Let's hope we don't meet the fate of Switzerland, who had to intervene in the currency markets to lower the value of the franc to make the country's exports less expensive...

Jeff

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

I assume there was some irony intended in the above?!Ferru123 wrote:Let's hope we don't meet the fate of Switzerland, who had to intervene in the currency markets to lower the value of the franc to make the country's exports less expensive...

You do not have the required permissions to view the files attached to this post.

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

UBS' Advice On What To Buy In Case Of Eurozone Breakup: "Precious Metals, Tinned Goods And Small Calibre Weapons"

http://www.zerohedge.com/news/ubs-advic ... bre-weapon

http://www.zerohedge.com/news/ubs-advic ... bre-weapon

From the Telegraph:

13.40 Boris Johnson, Mayor of London, has also called for a referendum if there's a treaty of 27. Speaking a few minutes ago on Radio 4's The World at One, he said that Europe has "long been envious" of Britain's dominant position in financial services and that David Cameron was "absolutely right" to defend British interests.

"It's absolutely clear to me that if there's a new treaty at 27, a new EU treaty, that creates a kind of fiscal union... then we'd have absolutely no choice either to veto it or put it to a referendum.

The real problem we've got now is that everybody is desperately scrabbling around to try and patch this thing together and to keep the euro in its current form whole and entire, and not to let anybody escape, not to let anybody devalue and to use the rather graphic phrase of someone the other day, I think we're in danger of saving the cancer and not the patient."

13.40 Boris Johnson, Mayor of London, has also called for a referendum if there's a treaty of 27. Speaking a few minutes ago on Radio 4's The World at One, he said that Europe has "long been envious" of Britain's dominant position in financial services and that David Cameron was "absolutely right" to defend British interests.

"It's absolutely clear to me that if there's a new treaty at 27, a new EU treaty, that creates a kind of fiscal union... then we'd have absolutely no choice either to veto it or put it to a referendum.

The real problem we've got now is that everybody is desperately scrabbling around to try and patch this thing together and to keep the euro in its current form whole and entire, and not to let anybody escape, not to let anybody devalue and to use the rather graphic phrase of someone the other day, I think we're in danger of saving the cancer and not the patient."

Cameron truly is the heir to Blair - http://jacob-campbell.comoj.com/cameron ... -to-blair/

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

French bank ratings downgraded again by Moody's

http://www.bbc.co.uk/news/business-16105237

the timing of the recent activity by the ratings agencies smells a bit fishy... on Monday S&P put 15 of the 17 EZ nations on negative watch for a downgrade and now this halfway thru the EU summit.

it wouldn't surprise me if the US is exerting political pressure on Europe to get what they want - the ECB to print - and using the agencies to turn the screw.

http://www.bbc.co.uk/news/business-16105237

the timing of the recent activity by the ratings agencies smells a bit fishy... on Monday S&P put 15 of the 17 EZ nations on negative watch for a downgrade and now this halfway thru the EU summit.

it wouldn't surprise me if the US is exerting political pressure on Europe to get what they want - the ECB to print - and using the agencies to turn the screw.

David Cameron vetoes EU-wide treaty change - http://www.bbc.co.uk/news/uk-16104275

Maybe Mr Cameron isn't a weak and gutless leader after all! The Lib Dems will be seething!

That said, I can't wonder whether he used his veto just to impress the eurosceptics, and will retract it in exchange for a few minor concessions...

Jeff

Maybe Mr Cameron isn't a weak and gutless leader after all! The Lib Dems will be seething!

That said, I can't wonder whether he used his veto just to impress the eurosceptics, and will retract it in exchange for a few minor concessions...

Jeff

- CaerMyrddin

- Posts: 1271

- Joined: Mon Sep 07, 2009 10:47 am

Imho what is happening is going to be a landmark in terms of economic history, in the western world you have to blocks that face the same problems but are using different strategies, Euro Club Vs US + UK. Independently of what happens in the future, if the euro club survives it will be in much better conditions to face the future, when compared to the other block.

Personally I sympathize the euro club strategy (no printing money, curative austerity) but think the tactics are failing to impress. The problem is political. Fiscal union with strict constitutional rules and a long term loan to the problematic countries would do the deal, but domestic politics and a lack of long term view are limiting politician's views.

That said, I'm a bit worried with all this situation and would like to ask everybody in the eurozone if they are taking any measures regarding the protection of your assets? I'm considering buying australian dollars...

Personally I sympathize the euro club strategy (no printing money, curative austerity) but think the tactics are failing to impress. The problem is political. Fiscal union with strict constitutional rules and a long term loan to the problematic countries would do the deal, but domestic politics and a lack of long term view are limiting politician's views.

That said, I'm a bit worried with all this situation and would like to ask everybody in the eurozone if they are taking any measures regarding the protection of your assets? I'm considering buying australian dollars...

The Euro was a great idea but badly executed and the result is what the original founders required and wanted in the first place, a united states of Europe. I think it will take a generation to mould together as all the individual countries are still obviously some distance apart in culture and fiscally.

The new treaty will probably be the right thing to save the Euro but the consequences will take some time to work through.

In the US the federal process emptied some stats and filled up others as migration and capital moved around. The same will probably happen in Europe over time I suspect, if all the countries stay in Union.

The Germans are being smart by insisting on member stats being held accountable and not getting the ECB involved. Else there is little incentive to pursue fiscal prudence.

I think the UK will have a lot of flexability by being in the trading bloc but outside the treaty, but this will inevitably cause tensions with EU partners.

I think it may be a short term win for the Uk but a long term win for the Euro countries, if they can get their act together.

The new treaty will probably be the right thing to save the Euro but the consequences will take some time to work through.

In the US the federal process emptied some stats and filled up others as migration and capital moved around. The same will probably happen in Europe over time I suspect, if all the countries stay in Union.

The Germans are being smart by insisting on member stats being held accountable and not getting the ECB involved. Else there is little incentive to pursue fiscal prudence.

I think the UK will have a lot of flexability by being in the trading bloc but outside the treaty, but this will inevitably cause tensions with EU partners.

I think it may be a short term win for the Uk but a long term win for the Euro countries, if they can get their act together.

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

that would have been a great strategy a couple of years ago. that said, it's probably still a reasonable bet given the prospects of the relative economies. i remember shorting GBP/AUD at 2.4 (but got out after a few days - that's one trade i really wish i'd hung on to!). the only possible fly in the ointment with Australia and AUD is that they are in an even bigger house price bubble than we are (theirs does have a bit more justification though to be fair).CaerMyrddin wrote:That said, I'm a bit worried with all this situation and would like to ask everybody in the eurozone if they are taking any measures regarding the protection of your assets? I'm considering buying australian dollars...

You do not have the required permissions to view the files attached to this post.

IMO it depends on to what extent the UK can hold its current level of access through the single market.

It's all very well Eurosceptics pointing out there is a £10 billion trade deficit with the EU.

We sell them £100 billion, and buy £110 billion, say.

If our access is limited, and there is every chance that the French in particular will work for that, we have to sell the £100 billion elsewhere...

That being said, I don't think Cameron had much of a choice.

Financial services are our one world class industry, despite all the anti banker rhetoric.

It's all very well Eurosceptics pointing out there is a £10 billion trade deficit with the EU.

We sell them £100 billion, and buy £110 billion, say.

If our access is limited, and there is every chance that the French in particular will work for that, we have to sell the £100 billion elsewhere...

That being said, I don't think Cameron had much of a choice.

Financial services are our one world class industry, despite all the anti banker rhetoric.