This is why trying to inflate away debts by printing money doesn't work... the inflation reduces demand because real incomes fall and hence the economy doesn't recover. The Central Bank of Zimbabwe will testify to that.The report also issues a stark warning of tough times for people in the so-called "squeezed middle" - with median incomes falling by 7%, after inflation has been taken into account, the sharpest drop in 35 years.

The effects of globalisation, for a while hidden by the bigger effects of the credit boom, mean that wages don't have a hope in hell of keeping pace.

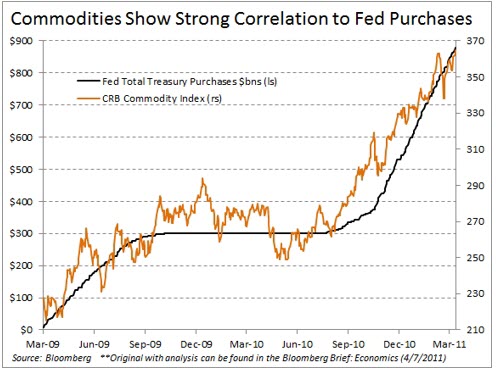

When the US pulls the trigger on QE3 commodities will rise again (just like they did with QE and QE2) which creates imported inflation that will stifle any hopes of real growth.